Stornoway Files for Bankruptcy Protection

Date: 15 Nov, 2023 | By John Jeffay

Canadian miner Stornoway Diamonds has filed for bankruptcy protection for the second time in four years, blaming a sudden drop in prices globally, as well as India’s two-month moratorium on rough purchases.

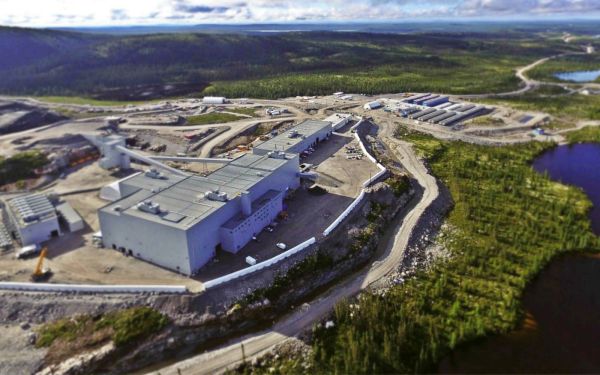

The company announced last Friday (27 October) that it was “temporarily suspending” operations at Renard – the first and only diamond mine in Quebec province – with immediate effect.

However the Quebec government’s investment agency Investissement Québec (IQ), which owns a 35 per cent equity stake in Stornoway, says it will not put any more money into the venture.

Economy Minister Pierre Fitzgibbon said the government wouldn’t take part financially in any recovery plan. “I haven’t seen the details, but I think this mine is over,” he told a press conference, according to Montreal Gazette report.

Stornoway has retained 75 of its 500-strong workforce to put the mine on care and maintenance. The remainder have been temporarily laid off.

The Montreal-based miner is filing for bankruptcy protection under Canada’s Companies’ Creditors Arrangement Act (CCAA) offering it protection from creditors while it attempts to restructure itself.

Stornoway is jointly owned by Osisko Gold Royalties Ltd., IQ, pension fund manager Caisse de dépôt et placement du Québec (CDPQ) and TF R&S Canada Ltd.

Osisko, a Canadian company that holds royalties in gold, silver and diamond mines, bought Stornoway in 2019 after it ran out of working capital, and restructured its share capital, which led to significant losses for small shareholders.

Stornoway, co-founded by Eira Thomas (former Lucara CEO) built Renard with a C$946-million financing package, coming in under budget and five months ahead of time. It began commercial production in January 2017.

The mines – two open pit and one underground – were expected to produce an average of 1.6m carats-a-year over an initial 14-year mine life.

But Renard, located in the James Bay region of north-central Quebec, suffered early problems with diamonds being broken during processing.

It was also forced to close from March 2020 because of the Covid pandemic.

It was allowed to re-open the following month but remained closed, blaming a collapse in diamond prices, amid global travel bans, social distancing and flat retail demand.

Its latest troubles stem from drop in diamond prices, exacerbated by a two-month voluntary ban on rough purchases by Indian manufacturers, which came into force on 15 October.

In a statement announcing its closure last week, the company said: “The growing uncertainty of the diamond price in the short and medium term, coupled with the significant and sudden drop in the price of the resource on the world market, have had a major impact on the company’s long-term financial situation.”

“This was in part due to the halt in the import of rough diamonds to India and by the global geopolitical climate.”

The Renard mine has proven and probable reserves of 11.8 Mct (16.8 Mt @ 70 cpht), according to the Osisko website.

It has measured and indicated resources (exclusive of reserves) of 3.7 Mct (8.7 Mt @ 43 cpht) and inferred resources of 13.0 Mct (23.4 Mt @ 56 cpht).

We approached the PR company respresenting Stornoway. It said there were no updates.